CARES Act Information

Per the Department of Education in its May 6, 2020 guidance regarding the Higher Education Emergency Relief Fund (HEERF), the following information must appear in a format and location that is easily accessible to the public 30 days after the date (April 20, 2020) when the institution received its allocation under 18004(a) (1) and updated every 45 days thereafter:

Requirement: An acknowledgement that the institution signed and returned the certification and agreement form and that the institution has used, or intends to use the funds to provide the mandated amount of at least 50% of the emergency financial aid grants to students.

- Illinois College signed and returned the CARES Act certification and agreement forms and Illinois College has used the funds to provide the mandated amount of at least 50% of the emergency financial aid grants to students.

Requirement: The total amount of funds that the institution will receive, or has received under the HEERF student portion.

- Illinois College has received $619,656 for the HEERF Student Aid Portion, Section 18004(a)(1), and has been awarded $619,655 for the HEERF Institutional Portion, Section 18004(c). Additionally, Illinois College has been awarded $60,201 from the HEERF Strengthening Institutions Program, Section 18004(a)(2).

Requirement: Of those funds, the total amount that has been distributed to students as of the date of reporting (i.e. the first 30-day deadline, and then every 45 days thereafter).

- Illinois College has distributed $619,656 (100%) of the Student Aid Portion, Section 18004(a)(1), to students as of July 1, 2020.

- Illinois College has distributed $495,920 (80%) of the Institutional Portion, Section 18004(c), to students as of July 1, 2020.

- Illinois College has distributed $0 from the HEERF Strengthening Institutions Program, Section 1800(a)(2) to students as of July 1, 2020.

Requirement: The estimated total number of students at the institution eligible to participate in programs under Section 484 in Title IV of the Higher Education Act of 1965 and therefore eligible to receive an emergency financial aid grant.

- 882 Illinois College students were eligible to participate in programs under Section 484 in Title IV of the Higher Education Act of 1965 and therefore met one of the eligibility criteria to receive an emergency financial aid grant.

- 675 students met all four eligibility criteria listed in the IC CARES Act Policy Statement on distribution of Emergency Financial Aid Grants to Students (see below).

Requirement: The total number of students who have received an emergency financial aid grant.

- 375 Illinois College students have received an emergency financial aid grant from the Student Aid Portion, Section 18004(a)(1), of funds that Illinois College received.

- 300 Illinois College students have received an emergency financial aid grant from the Institutional Portion, Section 18004(c), of funds that Illinois College received.

Requirement: How the institution determined which students did, or will receive emergency financial aid grants and how much funding they did, or will receive.

- Please see the following excerpt from Illinois College's CARES Act Policy Statement for information on how the College determined which students received emergency financial aid grants and how much funding they received as of May 31, 2020.

CARES Act Policy Statement on distribution of Emergency Financial Aid Grants to Students (Approved by Cabinet on April 27, 2020.)

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, Pub. L. No. 116-136 (March 27, 2020), authorizes the Secretary of Education to provide emergency financial aid grants to institutions of higher education. Section 18004(c) of the CARES Act requires the recipient institution to use no less than 50 percent of the funds received to provide emergency financial aid grants to students for expenses related to the disruption of campus operations due to the coronavirus (including eligible expenses under a student’s cost of attendance such as food, housing, course materials, technology, health care, and child care). Illinois College will administer these funds in accordance with its “Funding Certification and Agreement for the Emergency Financial Aid Grants to Students under the CARES Act,” dated April 10, 2020.

Section 18004(c) of the CARES Act allows the recipient institution to use up to 50 percent of the funds received to cover any costs associated with significant changes to the delivery of instruction due to the coronavirus so long as such costs do not include payment to contractors for the provision of pre-enrollment recruitment activities, including marketing and advertising; endowments; or capital outlays associated with facilities related to athletics, sectarian instruction, or religious worship (“Recipient’s Institutional Costs”). Recipient institutions may, but are not required to, use funds designated for Recipient’s Institutional Costs to provide additional emergency financial aid grants to students for expenses related to the disruption of campus operations due to coronavirus. If the recipient institution chooses to use funds designated for Recipient’s Institutional Costs to provide such emergency financial aid grants to students, then the funds are subject to the requirements in the “Funding Certification and Agreement for the Emergency Financial Aid Grants to Students under the CARES Act,” dated April 10, 2020.

In accordance with the Act and following the subsequent guidance provided by the Department of Education as of April 27, 2020, Illinois College calculated emergency financial aid grants for eligible students for distribution on May 1, 2020. Students were determined to be eligible to receive emergency financial aid grants if they met the following four criteria:

- Not 100%-online student in spring semester 2020.

- Lived in campus housing in spring semester 2020 prior to March 13, 2020.

- Departed campus housing before April 8, 2020, due to concerns about the pandemic.

- Met criteria for Title IV eligibility: Section 484 of the HEA states that Title IV eligible students must:

- Be enrolled or accepted for enrollment in a degree or certificate program.

- Not be enrolled in elementary or secondary school.

- For currently enrolled students, be making satisfactory academic progress.

- Not owe an overpayment on Title IV grants or loans.

- Not be in default on a Title IV loan.

- File "as part of the original financial aid application process" a certification that includes a statement of educational purpose.

- Have presented a Social Security Number to the institution.

- Be a U.S. citizen or national, permanent resident, or other eligible noncitizen.

- Have returned fraudulently obtained Title IV funds if convicted of or pled guilty or no contest to charges.

- Not have fraudulently received Title IV loans in excess of annual or aggregate limits.

- Have repaid Title IV loan amounts in excess of annual or aggregate limits if obtained inadvertently.

- Have Selective Service registration verified.

- Have Social Security Number verified.

- Not have a federal or state conviction for drug possession or sale, with certain time limitations.

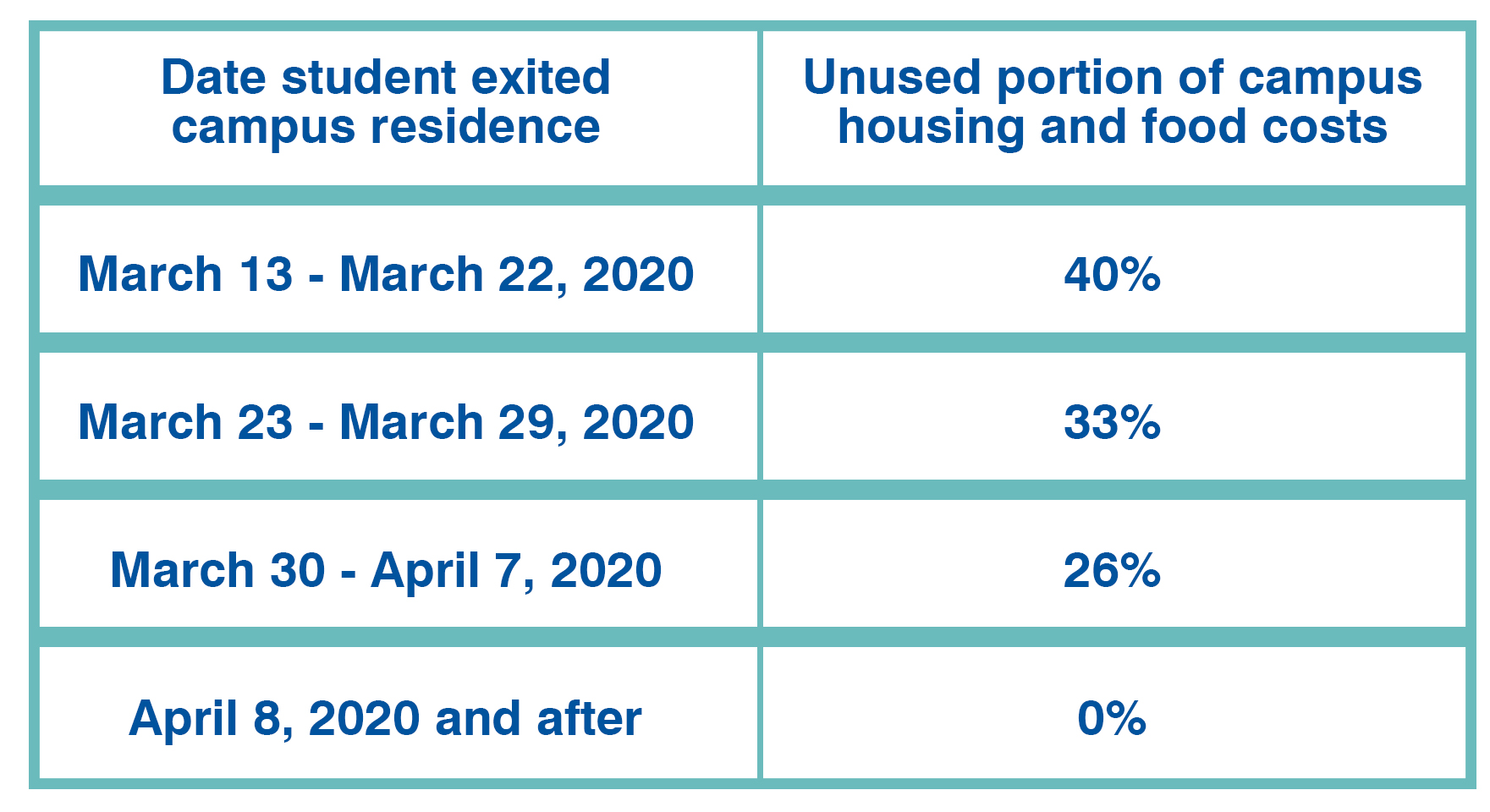

- The formula Illinois College used to calculate the amount of emergency financial aid grants for eligible students is:

Requirement: Any instructions, directions, or guidance provided by the institution to students concerning the emergency financial aid grants.

- Illinois College provided this information to students who were eligible through the institutional policy to receive emergency financial aid grants.

Reports

- September 30, 2020 Quarterly Budget and Expenditure Reporting under CARES Act Sections 18004(a)(1) Institutional Portion, and 18004(a)(2)

- December 31, 2020 Quarterly Budget and Expenditure Reporting under CARES Act Sections 18004(a)(1) Institutional Portion, and 18004(a)(2), and 18004(a)(3), if applicable

- March 31, 2021 Quarterly Budget and Expenditure Reporting under CARES Act Sections 18004(a)(1) Institutional Portion, and 18004(a)(2), and 18004(a)(3), if applicable, and amendments to the CARES Act under the Coronavirus Relief and Response Appropriations Act

- June 30, 2021 Quarterly Budget and Expenditure Reporting under CARES Act Sections 18004(a)(1) Institutional Portion, and 18004(a)(2), and 18004(a)(3), as amended by the Coronavirus Relief and Response Appropriations Act and the American Rescue Plan Act

- June 30, 2021 (AMENDED on 8/30/21) Quarterly Budget and Expenditure Reporting under CARES Act Sections 18004(a)(1) Institutional Portion, and 18004(a)(2), and 18004(a)(3), as amended by the Coronavirus Relief and Response Appropriations Act and the American Rescue Plan Act

- June 30, 2021 (AMENDED on 1/7/22) Quarterly Budget and Expenditure Reporting under CARES Act Sections 18004(a)(1) Institutional Portion, and 18004(a)(2), and 18004(a)(3), as amended by the Coronavirus Relief and Response Appropriations Act and the American Rescue Plan Act

- September 30, 2021 Quarterly Budget and Expenditure Reporting under CARES Act Sections 18004(a)(1) Institutional Portion, and 18004(a)(2), and 18004(a)(3), as amended by the Coronavirus Relief and Response Appropriations Act and the American Rescue Plan Act

- December 31, 2021 Quarterly Budget and Expenditure Reporting under CARES Act Sections 18004(a)(1) Institutional Portion, and 18004(a)(2), and 18004(a)(3), as amended by the Coronavirus Relief and Response Appropriations Act and the American Rescue Plan Act

- March 31, 2022 Quarterly Budget and Expenditure Reporting under CARES Act Sections 18004(a)(1) Institutional Portion, and 18004(a)(2), and 18004(a)(3), as amended by the Coronavirus Relief and Response Appropriations Act and the American Rescue Plan Act

- June 30, 2022 Quarterly Budget and Expenditure Reporting under CARES Act Sections 18004(a)(1) Institutional and Student Portions, and 18004(a)(2), and 18004(a)(3), as amended by the Coronavirus Relief and Response Appropriations Act and the American Rescue Plan Act

- March 31, 2023 Quarterly Budget and Expenditure Reporting under CARES Act Sections 18004(a)(1) Institutional Portion, and 18004(a)(2), and 18004(a)(3), as amended by the Coronavirus Relief and Response Appropriations Act and the American Rescue Plan Act

- June 30, 2023 Quarterly Budget and Expenditure Reporting under CARES Act Sections 18004(a)(1) Institutional Portion, and 18004(a)(2), and 18004(a)(3), as amended by the Coronavirus Relief and Response Appropriations Act and the American Rescue Plan Act

Quarterly Reports on Student Portion Funds as required by the CARES Act and amended by the Coronavirus Relief and Response Appropriations Act and the American Rescue Plan Act

- CARES Act Quarterly Report :: September 30, 2020

- CARES Act Quarterly Report :: December 31, 2020

- CARES Act Quarterly Report :: March 31, 2021

- CARES Act Quarterly Report :: June 30, 2021

- CARES Act Quarterly Report :: September 30, 2021

- CARES Act Quarterly Report :: December 31, 2021

- CARES Act Quarterly Report :: March 31, 2022

- CARES Act Quarterly Report :: September 30, 2022

- CARES Act Quarterly Report :: December 31, 2022

- CRRSAA Quarterly Report :: June 30, 2021

- CRRSAA Quarterly Report :: September 30, 2021

- CRRSAA Quarterly Report :: December 31, 2021

- CRRSAA Quarterly Report :: March 31, 2022

- ARP Quarterly Report :: September 30, 2021

- ARP Quarterly Report :: December 31, 2021

- ARP Quarterly Report :: March 31, 2022

FAQs Regarding the Federal CARES Act

- What is the CARES Act?

-

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, which became law in March 2020, provides economic relief to institutions of higher education and to students who incurred expenses related to the disruption of campus operations due to coronavirus.

The federal CARES Act has provided Higher Education Emergency Relief Fund (HEERF) funding to Illinois College and other institutions of higher education across the nation. Section 18004(c) of the CARES Act requires recipient institutions to use at least 50 percent of the funds received to provide emergency financial aid grants to students for expenses related to the disruption of campus operations due to the coronavirus. Illinois College surpassed this requirement by distributing 90 percent of its CARES Act funding directly to students on May 1, 2020.

- Why did I get this money?

-

The Department of Education has made CARES Act funds available to institutions nationwide. Each institution of higher education can decide how to distribute these funds, so you may learn that other colleges are distributing funds differently than IC has. Illinois College has chosen to provide funds to eligible students who were living in on-campus housing as of March 13, 2020, and who departed from their campus housing prior to April 8, 2020. These payments were released to students on May 1, 2020.

- Will I also receive a housing/food refund?

-

Read this carefully: if you have received CARES Act Emergency Financial Aid Grant funds via check or direct deposit, this is instead of any previously- communicated “refund” on your student account. We are following federal guidance to provide maximum flexibility to cover eligible students’ expenses related to the disruption of campus operations due to Coronavirus COVID-19.

- Does this mean my Illinois College account balance has been paid off?

-

No. Distribution of CARES Act funds is made directly to students and not applied by the College toward any outstanding balances that may still be owed by the student. As such, receipt of these funds does not indicate the student has satisfied their financial obligations to Illinois College for any charges incurred during the spring 2020 term or any terms prior. Please check your current account balance (through ic.afford.com or the IC Student Financial Services Office) to determine what you may still owe; this is the student’s responsibility.

- Can I use this money to pay off my IC balance?

-

Yes. Illinois College is not authorized to apply CARES Act funds toward any outstanding balances that may still be owed by a student. However, once the a student receives the payment of funds, they may choose to use the funds to pay off their outstanding account balance through ic.afford.com or by check mailed to the IC Student Financial Services Office.

- Can IC just apply the CARES Act funds to my account balance if I give my approval or permission?

-

No. Federal regulations stipulate that all CARES Act funds must be disbursed directly to the student and may not be applied toward outstanding balances. To use these funds to pay-off an outstanding balance with IC, a student must make a payment to their account through ic.afford.com or by check mailed to the IC Student Financial Services Office.

- Does this money count against my financial aid package?

-

No. Money from the CARES Act is not considered financial assistance under federal statute, nor Department of Education regulations. As such, these funds will not impact your eligibility for regular financial aid (e.g., grants, scholarships, loans).

- Is money received from the CARES Act considered taxable income?

-

No. The Internal Revenue Service (IRS) announced on May 7, 2020, that these funds will not be taxable. “Emergency financial aid grants under the CARES Act for unexpected expenses, unmet financial need, or expenses related to the disruption of campus operations on account of the COVID-19 pandemic, such as unexpected expenses for food, housing, course materials, technology, health care, or childcare, are qualified disaster relief payments under section 139 of the Internal Revenue Code. This grant is not includible in your gross income.”

- How do I apply these funds to my 2020 fall semester?

-

If you wish to apply all or part of your CARES Act Emergency Financial Aid Grant to your Illinois College student account balance, you will need to make an online payment at ic.afford.com or mail a personal check to Student Financial Services. You cannot return the CARES Act Emergency Financial Aid Grant check issued to you and have it applied to your account.

- Are Deferred Action for Childhood Arrivals (DACA) students eligible for CARES Act funds?

-

No. Guidance issued by the Department of Education indicates that students must be eligible to submit a FAFSA in order to qualify for the CARES Act funds. This limits eligibility only to U.S. Citizens, Permanent Residents, or other Title IV eligible non-citizens.

- Are international students eligible for CARES Act funds?

-

No. Guidance issued by the Department of Education indicates that students must be eligible to submit a FAFSA in order to qualify for the CARES Act funds. This limits eligibility only to U.S. Citizens, Permanent Residents, or other Title IV eligible non-citizens.

For information on Illinois College's use of CRRSAA (Coronavirus Response and Relief Supplemental Appropriations Act) also known as Higher Education Emergency Relief Fund (HEERF II), click here.

For information on Illinois College's use of ARP Act (American Rescue Plan Act) funding also known as Higher Education Emergency Relief Fund (HEERF III), click here.

For information on Illinois College's use of the GEER Fund (Governor's Emergency Education Relief), click here.

Posted May 18, 2020 | Updated on August 17, 2020 | Updated on September 17, 2020 | Updated November 3, 2020 | Updated January 8, 2021 | Updated April 10, 2021 | Updated July 10, 2021 | Updated August 27, 2021 | Updated September 10, 2021 | Updated October 10, 2021 | Updated January 10, 2022 | Updated March 1, 2022 | Updated April 10, 2022 | Updated June 21, 2022 | Updated July 7, 2022 | Updated October 10, 2022 | Updated April 17, 2023 | Updated July 10, 2023