We are excited to launch our new self-service and mobile-friendly financial aid tool: Student Financial Services Web Forms. Through this secure portal, you will be able to electronically sign documents and submit requested documents to our office. The link to Student Financial Services Web Forms is found within the IC Portal.

_0.png)

New Students: Access your IC Login information in your Admission Portal at admission.ic.edu

Verifying Income for 2023 - 2024

Some students who are selected for verification are required to confirm financial information on the FAFSA. Below are the approved ways to complete this process for the 2023 - 2024 academic year:

- IRS Data Retrieval Tool

- Signed copy of 2021 Federal Tax Return

- IRS 2021 Tax Return Transcript

- IRS 2021 Verification of Nonfiling statement - IRS Form 4506T

IRS Data Retrieval Tool (preferred method)

As a part of the FAFSA, this is the best way to verify income. It allows most FAFSA applicants and parents the ability to transfer their income information from the IRS to the FAFSA.

Helpful hint: Have a copy of your tax return in front of you when you are using the IRS Data Retrieval Tool. When attempting to link to the IRS from the FAFSA, the student/family address must be typed exactly as it appears on your tax return. The examples below show the same address typed a variety of ways and could result in the Data Retrieval Tool not working. Abbreviations and punctuation are very important!

1101 West College Avenue 1101 West College Ave

1101 W. College Ave. 1101 W College Ave.

1101 W College Avenue 1101 W. College Avenue

1101 W. College Ave 1101 W College Ave

- Go to www.fafsa.gov

- Log into the student's FAFSA using the student's FSA ID

- Select "Make FAFSA Corrections"

- Navigate to the Financial Information section from the tabs across the top of the screen

- Follow the instructions to determine is the student and/or student's parents are eligible to use the IRS Data Retrieval Tool to transfer 2021 IRS Income Tax Information

- If the student and/or parent(s) are eligible to use the IRS Data Retrieval Tool, link to the IRS Database. Enter the address exactly as it appears on the student/parent tax forms.

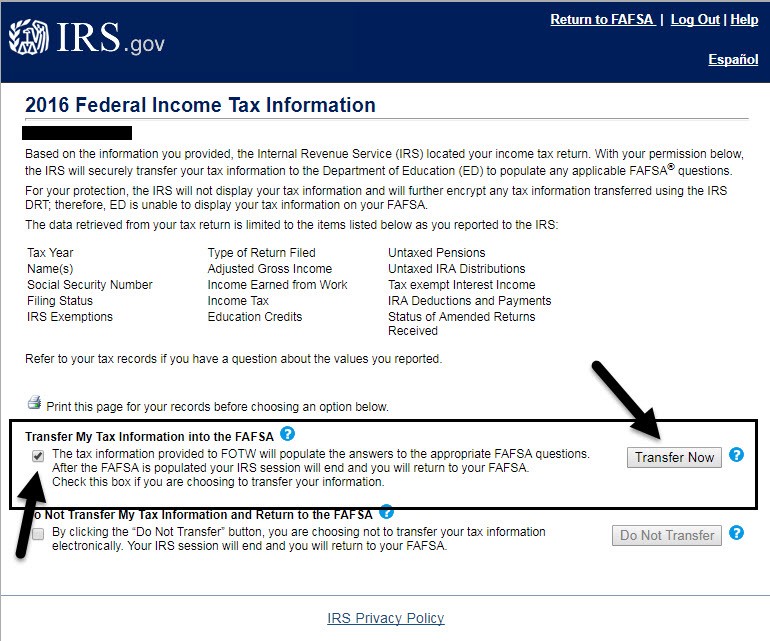

- After the information is loaded, click the box for "transfer my tax information into the FAFSA" and then hit "Transfer Now"

- After the data is successfully transferred, both the student and parent may be asked to sign the FAFSA again using their FSA IDs and passwords. Submit the FAFSA for the transferred information to be sent to the selected colleges.

IRS Tax Return Transcript

Some families will not be able or may choose not to use the IRS Data Retrieval Tool. To verify income for these families, the student and/or parent must submit a 2021 IRS Tax Return Transcript. Some examples of those who will not be able to use the IRS Data Retrieval Tool are:

- Married couples who filed separate tax returns for 2021

- Students and/or student's parent(s) whose marital status has changed as of January 1, 2021.

To obtain a 2021 IRS Tax Return Transcript:

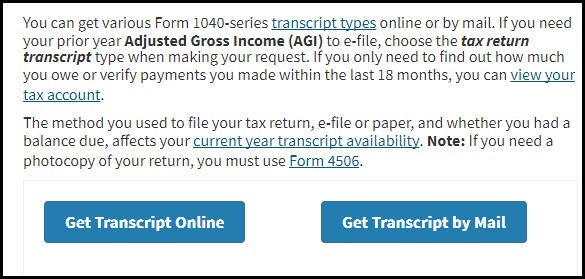

- Call 1.800.908.9946 -- or -- Go to www.irs.gov/Individuals/Get-Transcript

- Once the transcript is received, upload the document into the Student Financial Services Web Forms Portal.

Tax Return Non-Filers

If an independent student or parent(s) of a dependent student did not file and were not required to file a 2018 Federal Tax Return, the student and/or parent(s) must provide the Office of Student Financial Services with a statement from the IRS that confirms they did not file taxes in 2021. To receive this statement, the student and/or parent must submit IRS Form 4506-T to the IRS. Directions for submitting the form to the IRS Office are on the 2nd page of the form.

Additionally, the student and/or parent(s) must provide copies of all W2s for any income earned during 2018.

On the form, complete the top section and check the box for #7, indicating you are requesting verification of non-filing. For #9, enter 12/31/2021 to request verification of nonfiling for the 2021 tax year.

Directions for submitting the form to the IRS office are on the 2nd page of the form. Do not submit this form to Illinois College.

The verification of nonfiling is received, please upload the document into the Student Financial Services Web Forms Portal

Special Cases for Verifying Income

Amended Tax Returns

If the student or student's parent(s) amended their 2018 Federal Tax Return, they must submit the following to the Office of Student Financial Services through the Web Forms Portal:

- A signed copy of the original 2018 income tax return filed with the IRS

- A copy of their 2021 Tax Return Transcript

- A signed copy of the 2021 IRS Form 1040X filed with the IRS

Victims of Identity Theft

If the student or student's parent(s) have been notified by the IRS that they are a victim of tax-related identity theft, they will not be able to use the IRS Data Retrieval Tool or request a tax return transcript. Instead, they will need to request a 2021 Tax Return Database View Transcript of their tax return. A copy can be requested by calling 1.800.908.4490.

Additionally, the student or parent(s) will need to provide a signed and dated statement indicating that they are a victim of tax-related identity theft and that the IRS has been made aware of the situation.